In recent years, the rate and costs of fraudulent activities have skyrocketed. It is estimated that that 35% to 40% of new government applications are fraudulent claims. With the pandemic causing many industries to go digital in 2020, bad actors who are looking to acquire funds for themselves, instead of the intended recipients in need, have expanded exponentially. Fraud is at an all-time high.

What is fraud and why is it important?

We see fraud in many avenues of government. Specifically, in unauthorized access of a legitimate constituent’s account to obtain payments, claims, products, or services. Fraudulent activities can take many forms, including:

- Account takeover

- Creating fake user accounts

- Fraudulent filing of claims

- Changing payment addresses for distribution of claims

The cost of fraud is immense. Failure to fulfill financial mandates, the cost of security breaches, and loss of constituent trust are all consequences of agencies not having the right protections to safeguard legitimate claimants. State and local governments need preventative, proactive and low-friction protection to ensure safety and security for their constituents. Their constituents demand this of government.

Issues of fraud in the Public Sector

The public sector is particularly vulnerable to the threat of fraud and needs preventative measures to avoid rampant fraud. Bad actors target the public sector largely because they are easily accessible to everyone, and security is not optimal. Further, public sector entities are the stewards of large funds, and bad actors look to exploit these vulnerabilities with claims in public goods and government services such as unemployment claims, tax refunds, ecommerce, insurance, and telecommunications.

Slow adaptation to technology modernization in the public sector is one of the important factors for it to be vulnerable to fraud attack. Even for the agencies who are undergoing digital transformation or have advanced significantly in this journey, adoption of mobile and cloud technology imposes additional security risks as they do not have a network perimeter-centric control anymore.

There has been a massive uptick in cyber-attacks through the pandemic. Within the public sector, entire fraud rings have filed massive fraudulent unemployment claims to the tune of at least $34 billion, provided false supplier information, and sent phishing attacks to public sector employees via email. It is clear that public sector cybersecurity is in the crosshairs of the sophisticated adversaries.

COVID-19, digitization, and the rise of fraud

COVID-19 has literally pressed the digital accelerator. It can be difficult to keep up with the latest technological developments while managing the repercussions of the pandemic. This has left many companies and industries especially vulnerable to fraud. Industries with previously limited online presence have recently seen significant increases in digital engagement. Now that customers know that the digital world is an available option, they also recognize it is here to stay. This changes how and where fraud occurs.

With everything moving online rapidly, there are bound to be cracks in security. While the public sector has had to deal with the governmental impacts of COVID-19, they have also been forced into rapid digitization. Naturally, the overwhelming impact of COVID on the government has made the public sector a target.

Tools and procedures that reduce the impact and risk of fraud

Microsoft Dynamics 365 Fraud Protection

Although detecting fraud can feel like a game of Wac-a-Mole, there are helpful tools and procedures that state and local governments can put in place. Microsoft Dynamics 365 Fraud Protection offers several features including account protection, purchase protection, and loss prevention. D365 Fraud Protection can defend against fraud by using innovative and advanced capabilities, including:

- Adaptive AI and Machine Learning with pre-trained models

- Deep insights from the Fraud Protection Network

- Advanced Device fingerprinting

- Rules Engine and Virtual Fraud Analyst

- Graph Explorer and Scorecard

- Transaction Acceptance Booster

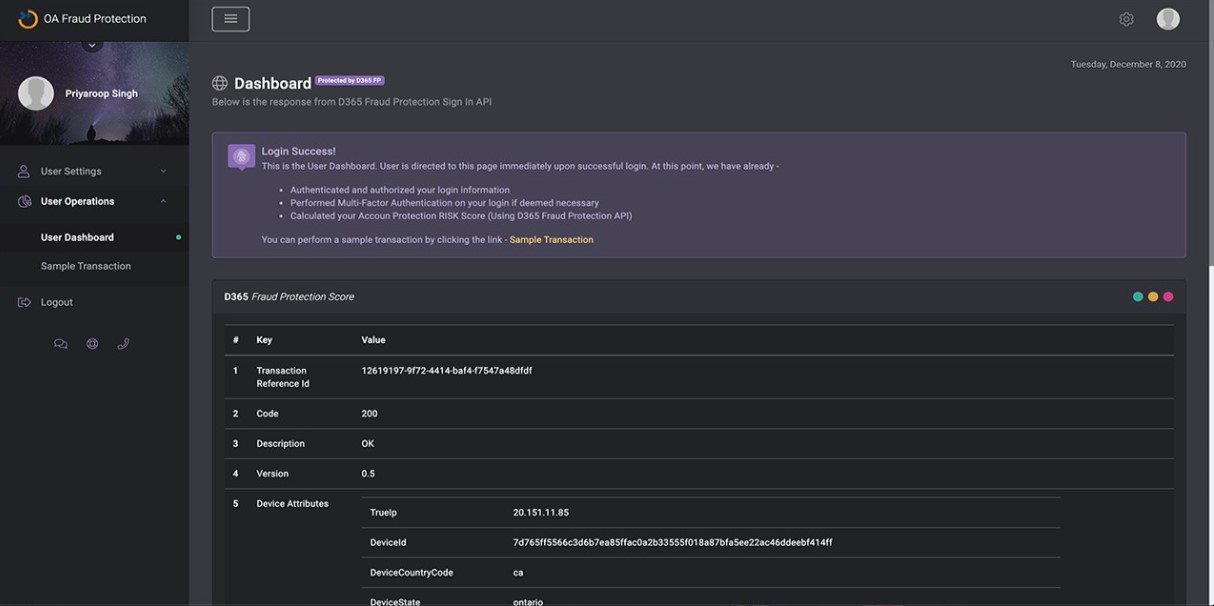

OnActuate Fraud Protection Solution

OnActuate is a global information technology and consulting firm. Our Fraud Protection Solution is an extension to D365 Fraud Protection. It uniquely builds user profiles to detect and stop fraud on a real-time basis. The extension offers account protection against fraud and identity verification services using knowledge-based verification (KBV) and ID document verification with Biometrics. This solution offers security at every step – from account setup to every transaction of a constituent lifecycle.

Our Fraud Protection Solution features include:

- Automated Escalation Management – Reduces investigator’s effort by automating the escalation process in case any anomaly is sensed by the solution.

- Full Transparency and Auditability – Provides tools to record and monitor every single action and activity for a 360-degree visibility of the user’s journey.

- Workflow Assistant – Offers provision to configure risk threshold values to enable relevant workflows for Fraud Detection.

- Blending Additional Scores – Risk Scores from external sources such as Credit Score of a customer is considering computing risk profile.

- Technology – Uses the most advanced, AI enabled and API First Technology.

- Quick & Easy Deployment – Seamless, efficient & quick integration with any application.

It’s time for the public sector to better protect themselves and their constituents from fraud.

OnActuate’s enhancements to Microsoft’s Dynamics Fraud Protection safeguards our Public Sector customers from bad actors and fraudsters, and stops them in their tracks. This saves our customers millions in fraud.

Contact us to learn more and take the first steps towards fighting fraud.